The world is running out of time to build the infrastructure needed to confront climate change. Rising seas, extreme heat, droughts, and intensifying storms are already reshaping economies and destroying development gains — yet the global investment response remains dangerously insufficient. UNCTAD estimates that developing countries face a $2.2 trillion annual financing gap for the energy transition and an additional $400 billion every year for climate adaptation. These are not abstract numbers; they reflect the scale of infrastructure transformation needed to power low-carbon growth, protect communities, and build resilience.

With COP30 currently underway in Belém, Brazil, the importance of bridging this gap has emerged as pressing priority. Progress on global climate objectives now relies on mobilizing greater investment for resilient, inclusive infrastructure, which is a core theme guiding COP30 discussions and implementation efforts.

Closing this gap is not simply a matter of mobilizing more money. It requires channeling capital where it is most needed, and structuring partnerships that align public priorities with private incentives. That is where international public-private partnerships (PPPs) can play a transformative role.

PPPs allow governments to harness private sector expertise, technology, and financing for long-term development projects. When well designed, they can deliver infrastructure more efficiently, share risk, and ensure accountability over decades.

For developing countries, international PPPs -those involving international investors - are particularly valuable: they bring foreign capital, technical know-how, and creditworthiness that domestic markets often lack.

Uneven progress in a fragmented landscape

Over the past decade, PPPs have become an increasingly common tool to finance infrastructure aligned with climate objectives. Yet, their distribution remains strikingly uneven. Ten developing countries - led by Brazil, India, Chile, Viet Nam, and the Philippines - account for nearly 60 per cent of all international PPP projects in developing economies, leaving many smaller and poorer economies behind. In least developed countries (LDCs), international PPPs represent roughly one-third of total PPP activity, but the absolute numbers remain marginal.

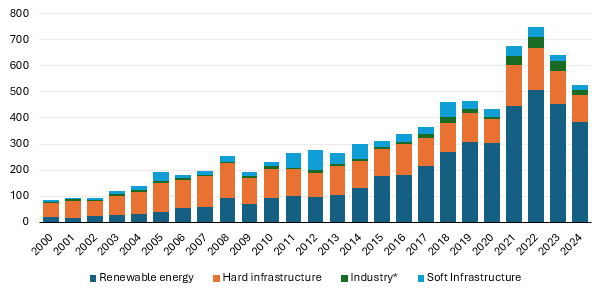

Since 2015, renewable energy projects have accounted for the largest share, representing more than 70 per cent of all international PPPs (figure 1). Although PPPs already play a significant role in financing renewable energy, much more investment is required. At the same time, parallel investment in broader sustainable infrastructure - including projects aimed at climate adaptation - is not keeping pace- .

Figure 1. Renewable energy has led international public-private partnerships in developing economies since 2015

International PPP deals in developing economies by sector

(Number)

Source: UNCTAD

* Industry: Includes deals involving SEZs, and selected industries that involve a partnership with host governments.

The global investment gap undermining sustainable development

The reasons behind these imbalances are structural. Many developing countries face limited institutional capacity, weak legal frameworks, and inadequate project preparation. Investors, in turn, perceive high risks - from currency volatility to regulatory uncertainty - that drive up borrowing costs and limit project pipelines.

UNCTAD’s research shows that a major constraint is the cost of capital. Infrastructure projects in developing countries face significantly higher interest rates compared to those in advanced economies. Development finance institutions (DFIs) and multilateral development banks (MDBs) play a catalytic role in addressing this challenge. Their participation through concessional loans, guarantees, or technical assistance helps de-risk projects, lengthen loan maturities, and attract private lenders. When MDBs are involved, on average, borrowing costs can drop by nearly 80 basis points, maturities extend by over two years and average loan size rises by more a third on average.

However, blended finance - the strategic use of public or concessional funds to mobilize private investment - remains limited. Expanding its reach, especially in high-risk environments such as LDCs and Small Island Developing States (SIDS), is essential to unlocking more international PPPs.

Moreover, adopting robust legal frameworks can make a measurable difference: the number of international PPP projects rises by up to 50 per cent in the years following the introduction of clear PPP legislation. Countries with dedicated PPP units and transparent procurement systems are better able to attract international sponsors, negotiate fair contracts, and avoid costly renegotiations.

A shared responsibility

Bridging the infrastructure gap will require a concerted global effort. Private capital alone cannot deliver the SDGs, but neither can governments act in isolation. The challenge is to design partnerships that balance risk and reward while safeguarding the public interest.

International PPPs, when underpinned by sound institutions and guided by sustainability goals, can help transform today’s financing shortfall into tomorrow’s climate-resilient development opportunity. They are not a silver bullet, but a strategic bridge between ambition and action - connecting global investors with local needs.

As COP30 seeks to turn climate ambition into implementation, aligning global financing frameworks with effective international partnerships is critical to deliver resilient and inclusive infrastructure where it is most needed.